Which of the following will make the real-world money multiplier smaller than the theoretical formula?

A. Banks actually hold fewer reserves than technically required by the Fed.

B. Banks actually make loans for more money than they have in excess reserves.

C. Banks may keep some excess reserves rather than loan it all out.

D. Consumers spend more than they have using credit cards.

Answer: C

You might also like to view...

If, in a given economy, production is taking place at a point inside the production possibility frontier:

a. resource allocation is technically and allocatively efficient. b. resource allocation is technically efficient but allocatively inefficient. c. resource allocation is technically inefficient and allocatively efficient. d. resource allocation is technically and allocatively inefficient.

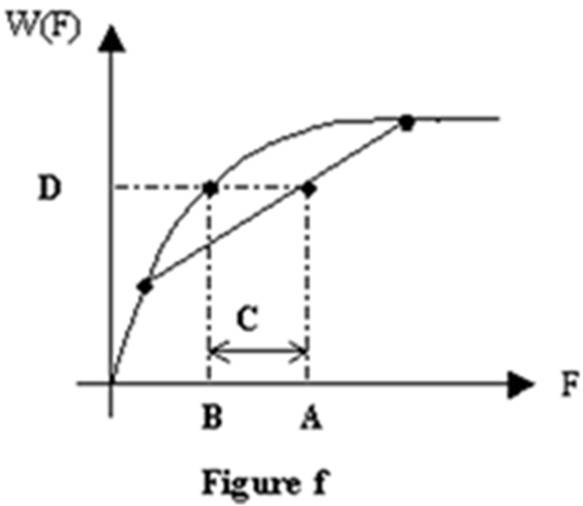

Refer to Figure f. A benefit function, W(F), is plotted in Figure f. The letter A represents:

A. the risk premium of the consumption bundle.

B. the expected utility of the consumption bundle.

C. the certainty equivalent of the consumption bundle.

D. the expected consumption.

In normal times, the actual money multiplier in the United States is:

A. sometimes negative during a recession. B. approximately equal to 10. C. approximately equal to 3. D. 0 in the long run and 3 in the short run.

In making consumer decisions that involve many options, each decision engages the cognitive process and ________ brain fuel. Eventually, the consumer is more likely to make ________ decisions.

A. generates; thoughtful B. generates; impulsive C. consumes; thoughtful D. consumes; impulsive