Which group is most likely to argue that an increase in government spending will be more effective than a reduction in taxes as a tool to promote recovery?

a. monetarists

b. Keynesian economists

c. supply-side economists

d. new classical economists

e. All of the above; there is a consensus on this issue.

B

You might also like to view...

Discuss the importance of rural-urban migration as a source of urban population growth in various parts of the developing world, being as specific as you can

What will be an ideal response?

The negative income tax has little support among economists because it distorts incentives to work.

Answer the following statement true (T) or false (F)

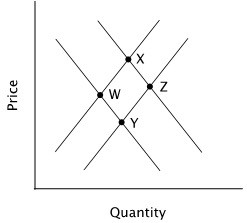

Refer to the accompanying figure. Assume the market is originally at point W. Movement to point X is the result of:

A. an increase in demand and an increase in quantity supplied. B. a decrease in supply and an increase in quantity demanded. C. an increase in supply and an increase in demand. D. an increase in supply and an increase in quantity demanded.

Which of the following transactions would be included in GDP?

A. Mary buys a used book for $5 at a garage sale. B. Nick buys $5,000 worth of stock in Microsoft. C. Olivia receives a tax refund of $500. D. Peter buys a newly constructed house.