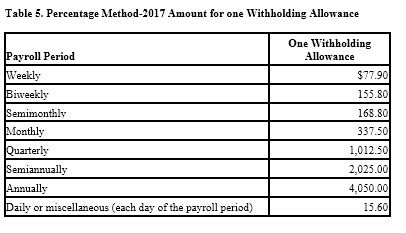

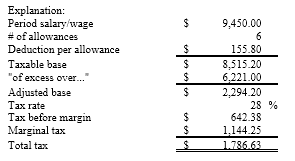

Warren is a married employee with six withholding allowances. During the most recent biweekly pay period, he earned $9,450.00. Using the percentage method, compute Warren's federal income tax. (Do not round interim calculations, only round final answer to two decimal points.)

A) $2,490.15

B) $2,156.90

C) $2,012.91

D) $1,786.63

D) $1,786.63

You might also like to view...

The auditor gathers audit evidence to test management's assertions.

Answer the following statement true (T) or false (F)

The Windows, Inc v. Jordan Panel Systems Corp case illustrated the concept that:

a. unless the parties expressly specify that the contract requires the seller to deliver to a particular destination, the contract is generally considered to be a shipment contract. b. unless the parties expressly designate the type of contract, it will be interpreted to be a destination contract. c. goods in the possession of a bailee which are to be delivered without being moved will have the risk of loss pass to the buyer when the buyer receives a negotiable document of title. d. express, specific provisions in a contract control as long as they are not unconscionable or grossly unfair to one of the parties.

Which of the following is a benefit ofholding large inventories?

A. Reduced holding costs B. Increased protection against losses due to depreciation C. Increased availability of funds D. Reduced ordering costs

A well-established, large, Brazil-based MNE will probably be most adversely affected by which of the following elements of firm value?

A) an open marketplace B) high-quality strategic management C) access to capital D) access to qualified labor pool