How are the rich able to shield large amounts of their income from sales tax while the poor typically cannot?

What will be an ideal response?

The poor typically consume all of their income and a very large percentage of it will be subject to the sales tax. By contrast the rich are able to save larger percentages of their income which effectively shield it from the sales tax.

You might also like to view...

In the final two decades of the twentieth century, average per capita global income

A) decreased by approximately 6 percent. B) increased by approximately 35 percent. C) increased by more than 75 percent. D) remained relatively unchanged.

In Figure 3-3 above, equilibrium income is

A) 400. B) 640. C) 666.67. D) 1,000. E) 2,400.

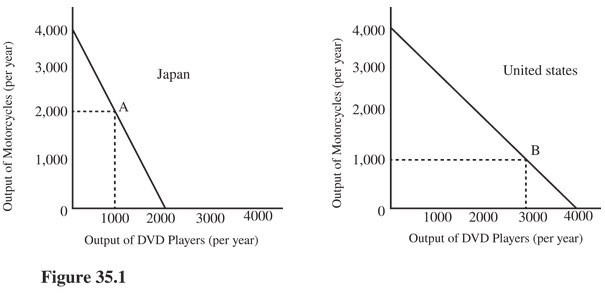

Compared to their initial positions at points A and B, as a result of complete specialization and trade, the output of the two countries added together in Figure 35.1 would result in an increase in

Compared to their initial positions at points A and B, as a result of complete specialization and trade, the output of the two countries added together in Figure 35.1 would result in an increase in

A. Neither DVD players nor motorcycles. B. Both DVD players and motorcycles. C. Motorcycles only. D. DVD players only.

A higher price for a good implies that

A) the marginal utility of the good has declined. B) the total value of the good to the consumer has increased. C) the sacrifice of utility of another good has increased. D) the marginal utility of another good has decreased.