The current year income statements for the Alpha Company and the Omega Company appear below:?Alpha CompanyOmega CompanyNet Sales$1,050,000$260,000Cost of goods sold475,000107,500Operating expense367,50073,000Required: 1) Prepare common size income statements for the Alpha Company and the Omega Company.2) What is the gross margin percentage for each company?3) What is the net income percentage for each company?4) Briefly comment on the pricing policies of each company as well as the ability to control expenses. Disregarding the difference in size, which company appears to be doing a better job?

What will be an ideal response?

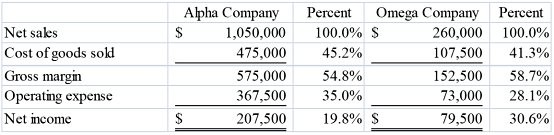

1)

2) Gross margin percentage = Gross margin ÷ Net sales:

Alpha Company 54.8%

Omega Company 58.7%

3) Net income percentage = Net income ÷ Net sales:

Alpha Company 19.8%

Omega Company 30.6%

4) The markup percentage is higher for the Omega Company. Omega is able to either charge relatively higher prices or is able to find a very advantageous supply source (or both). The percent of operating expenses is lower for the Omega Company which means that it is doing a good job in managing its expenses. The above information, plus the fact that net income is 30.6 cents per sales dollar, would indicate that Omega is operating in a more efficient and productive manner.

You might also like to view...

Why are stereotypes potentially harmful?

What will be an ideal response?

Which of the following is a type of research design?

A) Casual B) Exploratory C) Causal D) both A and B E) both B and C

Which of the following statements is not true when FLK Company discounts a note receivable to the bank?

a. FLK may ultimately have to pay the bank when the note is due. b. If the maker of the note pays the bank on time, no liability will result to FLK. c. FLK will receive the maturity value from the bank. d. A contingent liability arises for FLK.

How is the concept of industrial democracy consistent with the traditional values of the United States democratic system?

Fill in the blank(s) with the appropriate word(s).