The major objective of the 1986 tax reform was to: (i) enhance efficiency by lowering marginal tax rates; (ii) enhance equity by closing "loopholes."

a. i and ii

b. i but not ii

c. ii but not i

d. neither i nor ii

a

You might also like to view...

The reason that people may not want to hold money is

A) the precautionary demand for money and the risk of being robbed. B) the opportunity cost. C) the transactions demand makes it unnecessary. D) due to the direct relationship between money demand and the interest rate.

The "lemons" problem is that

a. cars of verifiable high quality are withheld from the used car market b. cars of verifiable low quality are withheld from the used car market c. cars of unverifiable high quality are withheld from the used car market d. cars of unverifiable low quality are withheld from the used car market

In the long-run equilibrium for a perfectly competitive market, firms will choose the level of output where

a. profit is minimized b. short-run average total cost is minimized c. long-run average total cost is minimized d. short-run profit is maximized e. long-run average fixed cost is minimized

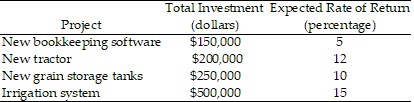

Refer to the data provided in Table 11.2 below to answer the following question(s). Table 11.2  Refer to Table 11.2. If the interest rate is 13%, then the farmer will engage in investment of

Refer to Table 11.2. If the interest rate is 13%, then the farmer will engage in investment of

A. $500,000. B. $600,000. C. $700,000. D. $1,100,000.