The Lanham Act has been amended by the:

A) Federal Trademark Dilution Act and the Trademark Cyberpiracy Prevention Act of 1999.

B) Only the Trademark Cyberpiracy Prevention Act of 1999.

C) Anti-counterfeiting Amendments Act of 2004 and the Trademark Cyberpiracy Prevention Act of 1999.

D) Only the Federal Trademark Dilution Act.

A

You might also like to view...

Answer the following statements true (T) or false (F)

1) A process costing system is most suitable for businesses that manufacture batches of unique products or provide specialized services. 2) In a process costing system, each process or department has its own Work-in-Process Inventory account. 3) A textile manufacturing company is most likely to use job order costing to arrive at the cost per yard of textile manufactured and sold to customers. 4) Process costing is the most appropriate costing method for a restaurant serving specialty cuisine. 5) Under process costing, direct materials and direct labor are assigned to Work-in-Process Inventory for each process that uses them.

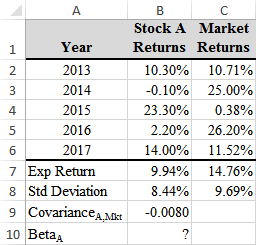

Which formula in B10 will correctly calculate the beta for Stock A?

a) =B9/C8

b) =C8/B9^2

c) =B9/B8^2

d) =B9/C8^2

e) =B9*C8^2

Organizational Behavior (OB) is considered a way of thinking.

Answer the following statement true (T) or false (F)

Alfred, a one-third profits and capital partner in Pizzeria Partnership, needs help in adjusting his tax basis to reflect the information contained in his most recent Schedule K-1 from the partnership. Unfortunately, the Schedule K-1 he recently received was for Year 3 of the partnership, but Alfred only knows that his tax basis at the beginning of Year 2 of the partnership was $23,000. Thankfully, Alfred still has his Schedule K-1 from the partnership for Years 1 and 2.Using the following information from Alfred's Year 1, Year 2, and Year 3 Schedule K-1, calculate his tax basis the end of Year 2 and Year 3. Year 1:Ordinary business income$10,000 Cash distribution$7,000 Alfred's share of partnership debt$85,000 Guaranteed payment$(4,500)Nondeductible expense$(1,000)Tax-exempt

income$1,200 Year 2:Ordinary business loss$(5,000)Cash contribution$10,000 Alfred's share of partnership debt$73,000 Guaranteed payment$(7,500)Nondeductible expense$(3,000)Tax-exempt income$1,500 Year 3:Ordinary business loss$(13,000)Alfred's share of partnership debt$58,000 Nondeductible expenses$(3,000)Guaranteed payment$(7,500) What will be an ideal response?