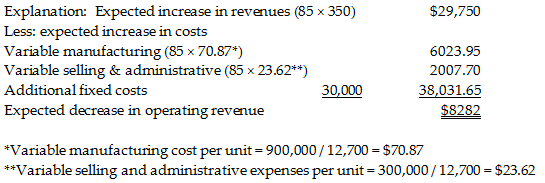

A foreign company has offered to buy 85 units for a reduced sales price of $350 per unit. The marketing manager says the sale will not affect the company's regular sales. The sales manager says that this sale will require variable selling and administrative costs. The production manager reports that it would require an additional $30,000 of fixed manufacturing costs to accommodate the specifications of the buyer. If Belfry accepts the deal, how will this impact operating income? (Round any intermediate calculations to the nearest cent, and your final answer to the nearest dollar.)

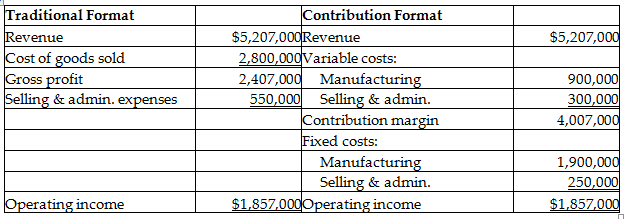

Belfry Company makes special equipment used in cell towers. Each unit sells for $410. Belfry produces and sells 12,700 units per year. They have provided the following income statement data:

A) Operating income will increase by $8282.

B) Operating income will decrease by $8282.

C) Operating income will increase by $29,750.

D) Operating income will decrease by $21,719.

B) Operating income will decrease by $8282.

You might also like to view...

Each of the adjustments on the work sheet must be journalized

Indicate whether the statement is true or false

An audit of the Flagler Company, a diamond mining company, brings to light the fact that its equipment has been marked up to the owners' expectation of market values. Such a situation will most likely result in which type of report?

a. Disclaimer. b. Review. c. Adverse. d. Unqualified with explanatory language.

Which of the following includes all the activities necessary to convert raw materials into a good or service and put it in the hands of the consumer or business customer?

A) the supply chain B) the value chain C) the channel of distribution D) the retailer chain E) the industrial network

Which term below is defined as independent workers who supply organizations with part-time talent for projects that need to be completed within a certain amount of time?

a. Part-time workers b. Job sharers c. Free agents d. Telecommuters