A new partner, Gary, contributes cash and assumes a share of partnership liabilities. Diane's capital, profits, and loss interest in the partnership is reduced by 5% due to the admission of Gary. The Sec. 751 rules do not apply. Partnership liabilities at the time Gary is admitted are $200,000, and all of the liabilities are recourse debts for which the partners share the economic risk of loss in

the same way they share partnership profits. Diane's basis in the partnership interest prior to Gary's admission is $5,000. Due to the admission of Gary, partner Diane has

A) no recognized gain or loss and a partnership interest basis of $10,000.

B) no recognized gain or loss.

C) a recognized gain of $5,000 and a partnership interest basis of zero.

D) a recognized gain of $5,000 and a partnership interest basis of $5,000.

C) a recognized gain of $5,000 and a partnership interest basis of zero.

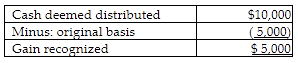

Diane's reduction in partnership liabilities by the addition of Gary is $10,000 (0.05 × $200,000 = $10,000). Because the $10,000 reduction is deemed cash distributed, Diane has a gain equal to the excess of the cash deemed distributed over her basis:

The new basis of Diane's partnership interest is zero.

You might also like to view...

Harper Company lends Hewell Company $40,000 on March 1, accepting a four-month, 6% interest note. HarperCompany prepares financial statements on March 31 . What adjusting entry should be made before the financialstatements can be prepared?

a. Cash 200 Interest Revenue 200 b. Interest Receivable Interest Revenue 800 800 c. Interest Receivable Interest Revenue 200 200 d. Note Receivable Cash 40,000 40,000

A company regularly purchases cleaning supplies from a vendor and orders relatively consistent amounts of the same products on each purchase from the same vendor. This is an example of a(n) ________

A) modified rebuy B) new task situation C) straight rebuy D) dual distribution system E) exclusive distribution system

The concept of strategic choice – meaning managers in positions of control make strategic decisions which effect the configuration of the organization – was developed by ____________.

a. Henry Mintzberg b. The Aston researchers c. Howard Aldrich d. John Child

Asset allocation is the process of allocating money across financial assets, such as stocks, bonds, and mutual funds, with the objective of eliminating risk altogether

Indicate whether the statement is true or false.