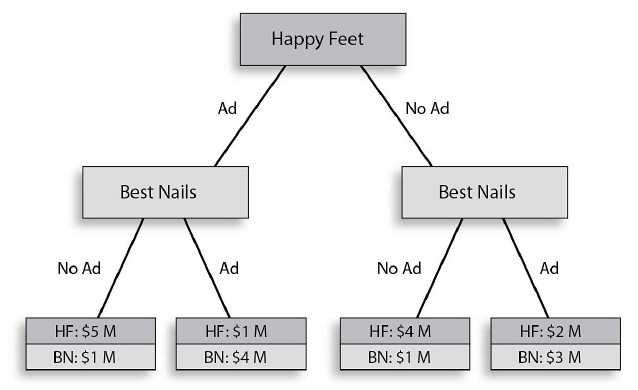

If Happy Feet chooses to No Ad and Best Nails then chooses to No Ad, Happy Feet earns ________ million in net profit and Best Nails earns ________ million.

Happy Feet wants to prevent Best Nails from entering the nail salon market. The above game tree illustrates the different strategies and corresponding payoffs for the two firms. Both Happy Feet and Best Nails have the same strategies of advertising (Ad) or not advertising (No Ad). The payoffs represent net profit in millions.

A) $1; $4 B) $2; $3 C) $4; $1 D) $5; $1

C) $4; $1

You might also like to view...

If the government increases the income tax rate, consumers have:

A. less to spend and will reduce their consumption. B. more to spend and will reduce their consumption. C. less to spend and will increase their consumption. D. more to spend and will increase their consumption.

Which of the following is likely to push the federal debt increasingly higher in the coming decades?

a. a strong rebound from the recession of 2008-2009 b. increased expenditures on the Social Security and Medicare programs c. an increase in tax revenues as the baby boom generation retires d. increased political pressure to balance federal budgets

Last year, Casey grew fresh vegetables, which she sold at her local farmers market, but this year, Casey did not plant any vegetables and went to work at a bank instead. Which of the following best explains Casey's career change?

A. Casey's opportunity costs of gardening exceeded Casey's opportunity costs of working at the bank. B. Casey's opportunity costs of working at the bank exceeded Casey's opportunity costs of gardening. C. Casey's opportunity costs of gardening exceeded Casey's benefits from working at the bank. D. Casey's opportunity costs of working at the bank exceeded Casey's benefits from gardening.

The added return an investor needs to compensate for the risks of future payments is called a(n)

A. internal rate of return. B. present discounted value. C. marginal risk product. D. risk premium.