Assume that the expectation of a recession next year causes business investments and household consumption to fall, as well as the financing to support it. If the nation has low mobility international capital markets and a fixed exchange rate system, what happens to the nominal exchange rate and the monetary base in the context of the Three-Sector-Model?

a. The nominal exchange rate remains the

same and monetary base rises.

b. The nominal exchange rate falls and monetary base falls.

c. The nominal exchange rate remains the same and monetary base falls.

d. The nominal exchange rate and monetary base remain the same.

e. There is not enough information to determine what happens to these two macroeconomic variables.

.A

You might also like to view...

Labor productivity has grown at almost the same rate each year over the last 40 years in the United States

Indicate whether the statement is true or false

If the amount of money in circulation is $50 million and nominal GDP is $150 million, then the velocity of money is: a. 0.33

b. 2. c. 3. d. impossible to determine from the information provided.

Spain is an importer of computer chips, taking the world price of $12 per chip as given. Suppose Spain imposes a $5 tariff on chips. As a result,

a. Spanish consumers of chips and Spanish producers of chips both gain. b. Spanish consumers of chips gain and Spanish producers of chips lose. c. Spanish consumers of chips lose and Spanish producers of chips gain. d. Spanish consumers of chips and Spanish producers of chips both lose.

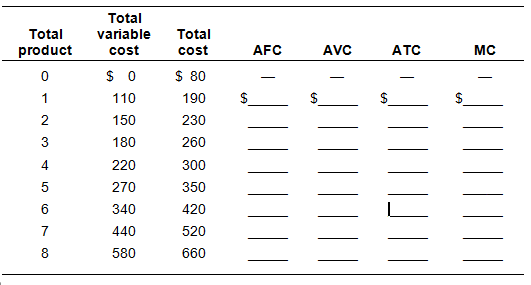

Assume a firm has fixed costs of $80 and variable costs as indicated in the table below. Complete the cost table