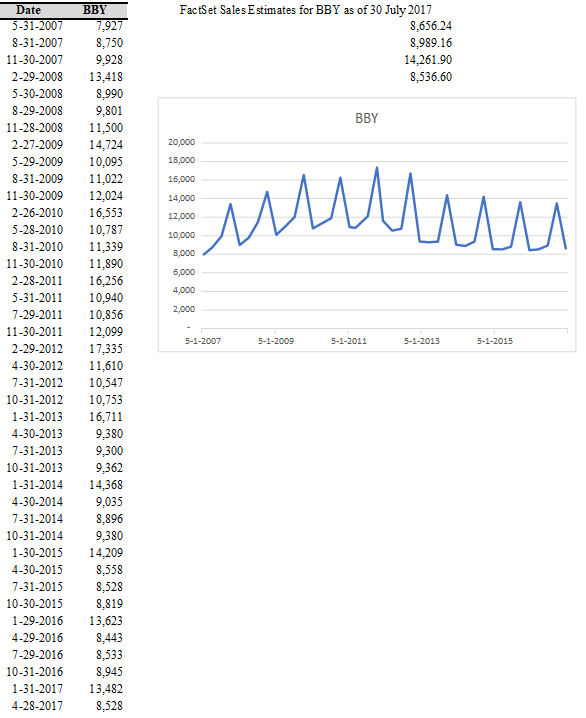

Using the Best Buy revenue data:

a) Fit the sales data using the Holt-Winters Multiplicative Seasonal model.

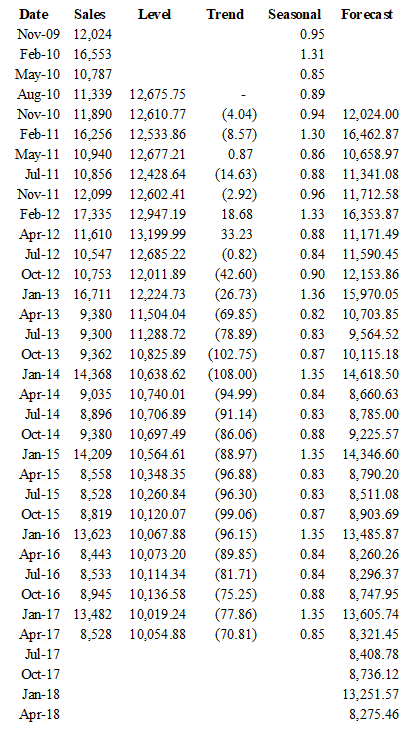

b) Find the optimal smoothing constants (?, ?, and ?) using the Solver. Set the Solver to minimize the MSE, and be sure to constrain the smoothing parameters to be between 0 and 1. What are the optimal values?

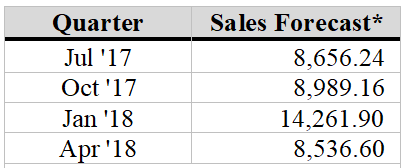

c) Using the model that you have created, forecast quarterly revenues for the next year.

d) According to FactSet, analysts are forecasting the following revenues for the next year. How do your numbers compare?

Alpha 0.4600

Beta 0.0621

Gamma 0.8864

MSE 303,469

MAPE 3.69%

a) See the fit at left.

b) The optimal parameters are:

a = 0.4600, b = 0.0621, g = 0.8864

c) See forecasts in F33:F36

d) Our model is forecasting lower sales in each quarter than analysts expectations, though generally closer to expectations than the additive model.

e) The multiplicative has a lower MSE and also lower MAPE, indicating a better fit.

FactSet Sales Estimates for BBY as of 30 July 2017

8,656.24 97.14%

8,989.16 97.19%

14,261.90 92.92%

8,536.60 96.94%

You might also like to view...

Arminda, who sells wicker furniture, invites the owner of Stanley Furniture to watch a demonstration outside. Arminda pours a five-gallon bucket of water on a wicker chair, talks to the storeowner for about 10 minutes, and then sits in the chair to show its water-resistance. Assuming she had the customer's attention and interest as soon as she poured the water on the chair, Arminda was trying to move the prospect into which stage next?

A. Development B. Conviction C. Desire D. Purchase E. Plan

The obligation people owe each other not to cause any unreasonable harm or risk of harm is termed ________.

A. libel B. res ipsa loquitur C. Good Samaritan law D. the duty of care

If the ________ is greater than or equal to the ________, the project should be accepted

A) IRR; NPV B) cost of capital; IRR C) IRR; cost of capital D) NPV; IRR E) NPV; discount rate

A company issues 8% bonds with a par value of $40,000 at par on January 1. The market rate on the date of issuance was 7%. The bonds pay interest semiannually on January 1 and July 1. The cash paid on July 1 to the bond holder(s) is:

A. $1,400. B. $1,600. C. $3,200. D. $0. E. $2,800.