The inflation tax refers to

a. the revenue a government creates by printing money.

b. higher inflation which requires more frequent price changes.

c. the idea that, other things the same, an increase in the tax rate raises the inflation rate.

d. taxes being indexed for inflation.

a

You might also like to view...

If the CPI was 132.5 at the end of last year and 140.2 at the end of this year, the inflation rate over these two years was

A) 7.7 percent. B) 5.4 percent. C) 4.4 percent. D) 5.8 percent.

The figure above shows Sam's budget line. Which of the following equals the vertical intercept of Sam's budget line?

A) Y/Pc B) Y/Pg C) -(Pc/Pg) D) -(Pg/Pc)

The monopolistically competitive firm maximizes profit by producing to the point at which

A) ATC = AVC. B) MC = MR. C) MR = AR. D) MC = AR.

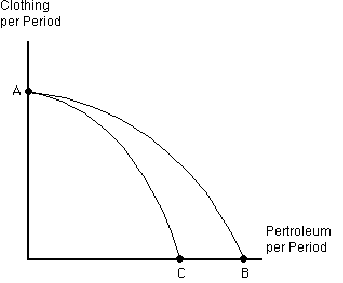

Figure 2-7

Which of the following could explain the shift in the production possibilities frontier from AB to AC in ?

a.

a productive improvement in petroleum production that has no effect on clothing production

b.

a productive improvement in clothing production that has no effect on petroleum production

c.

an increase in the size of the labor force that can produce either petroleum products or clothing

d.

oil drilling in Alaska is ended in order to protect the environment

e.

major oil reserves are discovered off the coast of Africa