A speculator who takes a long position in a market buys low and sells high, whereas a speculator who taxes a short position in a market buys high and sells low.

Answer the following statement true (T) or false (F)

False

Rationale: Speculators always try to buy low and sell high. Taking a long position means betting that prices will rise -- and thus buying now in anticipation of selling later. Taking a short position means betting that prices will fall -- and thus borrowing now to sell now and planning to repay later by buying at a lower price.

You might also like to view...

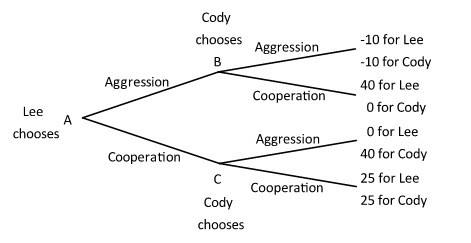

Lee and Cody are playing a game in which Lee has the first move at A in the decision tree shown below. Once Lee has chosen either aggression or cooperation, Cody, who can see what Lee has chosen, must choose either aggression or cooperation at B or C. Both players know the payoffs at the end of each branch.  If Lee chooses aggression, Cody will respond with ________, and if Lee chooses cooperation, Cody will respond with ________.

If Lee chooses aggression, Cody will respond with ________, and if Lee chooses cooperation, Cody will respond with ________.

A. aggression; aggression B. cooperation; aggression C. cooperation; cooperation D. aggression; cooperation

According to the standard government definitions, the percentage of the U.S. population now (2011) considered to be living in poverty is about:

A. 15.0 percent. B. 20.5 percent. C. 9.8 percent. D. 13.2 percent.

Cheating in a cartel is more likely to occur if the industry

A) has a large number of firms. B) has homogeneous products. C) has easily observable prices. D) has little ability to affect market prices.

Marginal cost pricing in competitive markets results in all but which one of the following?

A. Maximization of consumer utility. B. An efficient mix of goods and services being produced. C. Output being produced where price equals the opportunity cost of the last unit being produced. D. The information necessary for consumers to make rational choices between alternative goods and services.