Answer the following statements true (T) or false (F)

1. If everyone had the same income, the Lorenz curve would become the line of income equality.

2. The farther the Lorenz curve bows away from the line of income inequality, the greater is the inequality of income distribution.

3. If new, highly progressive tax laws are enacted, the resulting Lorenz curve will move to the right-hand corner of the graph.

4. A country with an equal distribution of income will have a higher standard of living than a country with a more unequal distribution of income.

5. If income were distributed solely according to productivity, some individuals would not receive any income.

1. TRUE

2. TRUE

3. FALSE

4. TRUE

5. FALSE

You might also like to view...

The percentage of workers who work part time for noneconomic reasons

A) has decreased from 30 percent of the labor force in 1980 to 20 percent in 2011. B) does not fluctuate much at all with the business cycle. C) has trended upward since 1980. D) fluctuates strongly with the business cycle. E) decreases during a recession as the number of discouraged workers increases.

Which of the following actions could be undertaken if the government wants to reduce an inflationary gap?

A) Increase taxes and reduce government spending. B) Reduce taxes and increase government spending. C) Increase taxes and increase government spending. D) Reduce taxes and reduce government spending.

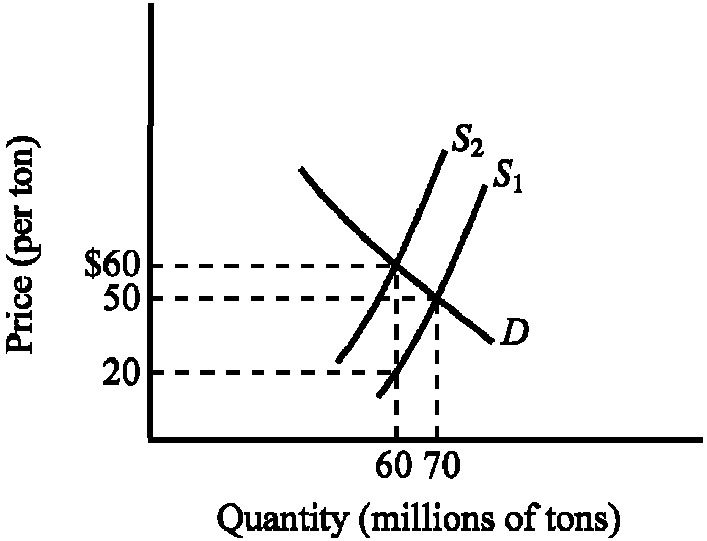

Refer to Figure 4-8. How much revenue does the $40-per-ton tax generate for the government?

a. $600 million

b. $700 million

c. $2.4 billion

d. $2.8 billion

If low-income households spend a larger share of their income on food than do high-income households, then a tax on food is:

A. a way to redistribute from the wealthy to the poor. B. a regressive tax. C. a proportional tax. D. a progressive tax.