Agreement between firms in an industry to set a certain price or to share a market is

a. a coordinating practice.

b. a competitive practice.

c. the substitution effect.

d. a collusive practice.

d. a collusive practice.

You might also like to view...

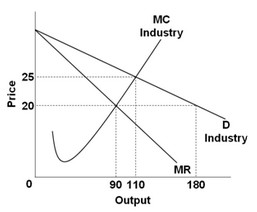

Use the following graph to answer the next question.  If the industry were perfectly competitive, then the market price would be ________.

If the industry were perfectly competitive, then the market price would be ________.

A. $20, which is lower than what the price would have been if the industry were a pure monopoly B. $25, which is lower than what the price would have been if the industry were a pure monopoly C. $25, which is higher than what the price would have been if the industry were a pure monopoly D. $20, which is higher than what the price would have been if the industry were a pure monopoly

If MPC = 0.8, a $200 billion increase in government purchases would have what size effect on the "first round" of induced added consumption, and what total effect on AD?

a. increase "first round" consumption by $80 billion; increase AD by $400 billion b. increase "first round" consumption by $160 billion; increase AD by $1 trillion c. increase "first round" consumption by $200 billion; increase AD by $1 trillion d. increase "first round" consumption by $800 billion; increase AD by $4 trillion

Suppose a country increases trade restrictions. This country would be pursing an

a. inward policy, which most economists believe has beneficial effects on the economy. b. inward policy, which most economists believe has adverse effects on the economy. c. outward policy, which most economists believe has beneficial effects on the economy. d. outward policy, which most economists believe has adverse effects on the economy.

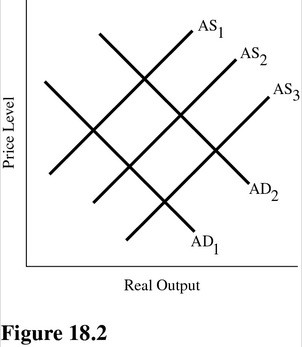

Refer to Figure 18.2. Which of the following is not consistent with a shift from AS2 to AS1?

Refer to Figure 18.2. Which of the following is not consistent with a shift from AS2 to AS1?

A. A major natural disaster such as an earthquake. B. A decrease in business taxes. C. Stagflation. D. An inward shift of the production possibilities curve.