If the Fed sells government bonds in the open market, it will cause:

A) a downward movement along the supply curve for reserves.

B) a shift of the supply curve for reserves to the left.

C) a shift of the supply curve for reserves to the right.

D) an upward movement along the supply curve for reserves.

B

You might also like to view...

Suppose that the federal government had a budget deficit of $80 billion in year 1 and $10 billion in year 2, but it had budget surpluses of $140 billion in year 3 and $20 billion in year 4. Also assume that the government uses any budget surpluses to pay down the public debt. At the end of these four years, the Federal government's public debt would have

A) increased by $250 billion. B) decreased by $70 billion. C) decreased by $62.5 billion. D) increased by $70 billion.

Monetary policy is most effective at home when exchange rates are flexible

Indicate whether the statement is true or false

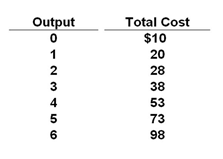

Refer to the table below. The total variable cost of producing 5 units is:

A. $10

B. $14.60

C. $63

D. $73

What happens to equilibrium quantity when simultaneously demand increases and supply decreases?

A. Equilibrium quantity will increase. B. Equilibrium quantity will decrease. C. Equilibrium quantity will remain the same. D. Equilibrium quantity may increase, decrease, or remain the same depending on the magnitude of the shifts in demand and supply.