Considering the euro-U.S. dollar market, as a euro purchases a larger number of U.S. dollars, we should see:

A. the quantity of dollars supplied increase.

B. a decrease in American exports to Europe.

C. the quantity of dollars demanded decrease.

D. an increase in the purchase of U.S. assets by Europeans.

Answer: D

You might also like to view...

What is the primary reason exchange rates were overvalued under ISI?

What will be an ideal response?

Economist Jones favors a constant-money-growth-rate rule. She says that if the annual money supply growth rate each year is equal to the average annual growth rate in Real GDP, price stability will exist over time. What would economist Smith, who favors activist monetary policy, say to economist Jones?

A) Your analysis assumes that Real GDP is constant over time, and it is not. B) Your analysis assumes that velocity is constant, and it is not. C) Your analysis assumes that you can correctly define the money supply. D) b and c E) a, b and c

Recall the Application about food and drink pricing during "happy hour" at bars and restaurants to answer the following question(s).Recall the Application. In a market subject to monopolistic competition, a restaurant's rational response to more elastic demand is to increase its price.

Answer the following statement true (T) or false (F)

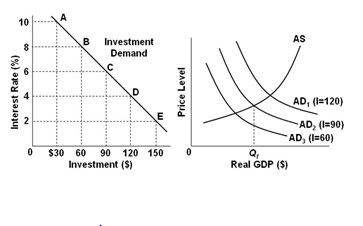

Refer to the graphs, in which the numbers in parentheses near the AD1, AD2, and AD3 labels indicate the level of investment spending associated with each curve, respectively. All numbers are in billions of dollars. The interest rate and the level of investment spending in the economy are at point D on the investment demand curve. To achieve the long-run goal of a noninflationary full-employment output Qf in the economy, the Fed should try to:

A. Decrease aggregate demand by increasing the interest rate from 2 to 4 percent

B. Decrease aggregate demand by increasing the interest rate from 4 to 6 percent

C. Increase aggregate demand by decreasing the interest rate from 4 to 2 percent

D. Increase the level of investment spending from $120 billion to $150 billion