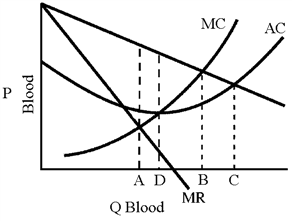

Figure 11-1

The Red Cross is virtually the only operator of blood banks in the United States. In Figure 11-1 are the demand and cost curves facing the Red Cross blood bank. If the Red Cross were to set price and quantity at the level that it would obtain in the long run in a competitive industry, how much blood would it sell?

a.

OA

b.

OB

c.

OD

d.

OC

d

You might also like to view...

In the movie "Baby Boom", Dianne Keaton finds out that a relative tragically died in an accident and bequeathed her an infant. The movie then explores how Dianne Keaton makes fundamentally different choices as a result of this unexpected change in her life. It makes the point that new parents often emphasize -- our "tastes change" when children enter the household. a. Consider Dianne Keaton's budget constraint over leisure (on the horizontal axis) and consumption (on the vertical). What is the slope of the budget constraint? Indicate her optimal choice A prior to finding out she suddenly has an infant child. b. Suppose that the child came with a trust fund that permits Dianne Keaton to charge any child-related expenses to that fund. Thus, the child does not come with any additional

expenses - and the budget constraint you derived in part (a) does not change. Still, we observe that Dianne Keaton now chooses more leisure and less consumption. What must have happened to the marginal rate of substitution at the bundle A in order for us to make sense of Dianne Keaton's change in behavior? c. Draw the indifference curve through A before and after Dianne Keaton finds out she suddenly has a child. If you ordinarily saw two such indifference curves (outside the context of this example), could you think that these could emerge from the same map of indifference curves or would you think they represent indifference curves from two different people whose tastes differ? Explain. d. Economists tend to resist the temptation of explaining changes in behavior as resulting from changes in tastes. Rather, we tend to think of changes in behavior as arising from changes in circumstances. Suppose that Dianne Keaton's tastes are actually over three "goods" - consumption of goods and leisure -- and "consumption" of children. Dianne Keaton's true indifference curves would thus be three dimensional - with your graphs so far representing two dimensional "slices". When viewed in this light, could the 2-dimensional indifference curves you graphed in (c) arise from a single set of 3-dimensional indifference surfaces? Explain (without attempting to graph anything in 3 dimensions). e. Suppose that it had always been an option for Dianne Keaton to adopt a child, and suppose that the cost of doing so is negligible. If Dianne Keaton reports being happier after she inherits her relative's child, was she fully optimizing before (assuming that she attaches no particular value to the fact that the child she inherited was her relative's)? f. In principle, could Dianne Keaton's tastes be such that she works more when she gets the child and is still happier than before? Under the usual assumption about tastes - and treating children the way we treat goods - could Dianne Keaton be less happy as a result of getting the child? What will be an ideal response?

What concept is involved when one disproportionately powerful actor can help provide the collective good, either directly or indirectly?

a. sustainability b. selective incentive c. privatization d. hegemony

The World View "Rebounding Oil Price Spurs More Rigs" related to oil prices and oil rigs suggests.

A. Oil rigs have found new supplies of oil, indicating that the demand for oil is inelastic. B. As the price of oil rises, the quantity supplied falls. C. As the price of oil increases, there is an increase in oil rigs and thus the amount of quantity supplied, indicating that supply is elastic. D. Oil rigs around the world have had difficulty finding additional sources of oil, indicating that the elasticity of supply is inelastic.

Consider a small open economy in equilibrium with a zero current account balance. What happens to national saving, investment, and the current account balance in equilibrium if(a)future income rises?(b)business taxes rise?(c)government expenditures decline temporarily?(d)the future marginal product of capital rises?

What will be an ideal response?