Use the concepts of reputation and asymmetric information to explain why some faculty members become less productive after gaining tenure.

What will be an ideal response?

Asymmetric information exists when all parties do not have full information or when some information is being withheld. In order to gain tenure, among other things, professors must publish considerably over a long period of time. Publications not only signal skills and ability, but also productivity. In the absence of the requirement of publications for tenure, some professors might choose to not publish as much, if not at all. These professors know something about themselves that the tenure committee may not: they do not enjoy publishing or at least would not choose to do it to the same degree in the absence of the requirement. Some may publish solely to earn the reputation needed to achieve tenure. Once tenure is achieved, those who were only productive in the publication sense in order to gain tenure will become less so as there is no need to build their reputation any longer. (This is assuming no other advancement is desired.)

You might also like to view...

Suppose the required reserve ratio is 5%. If banks are conservative and choose not to loan all of their excess reserves, the actual money multiplier is

A) less than 20. B) greater than 20. C) equal to 20 D) equal to 5.

Intense market competition is ________ for consumers, since it_______

a. Bad; erodes producer surplus b. Bad, increases variety in the market c. Good, increases the price level in the market d. Good; decreases the price level in the market

If the opportunity costs of producing a good increase as more of that good is produced, the economy's production possibility frontier will be

A. a negatively sloped straight line. B. negatively sloped and "bowed inward" toward the origin. C. negatively sloped and "bowed outward" from the origin. D. a positively sloped straight line.

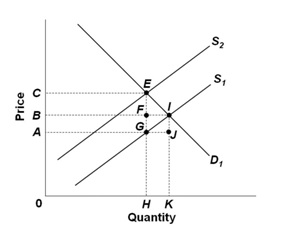

The graph below represents the market for a product where D1 and S1 show the initial supply and demand curves, and supply shifts to S2 due to a sales tax. The deadweight loss due to the tax is represented by area:

A. EIG

B. EFI

C. BCEF

D. ABFG