Explain how an interest rate futures contract differs from an outright purchase of a bond.

What will be an ideal response?

An investor who purchases a bond does so with the thought that the price of a bond is going to rise. There really is no way to profit from a price decline when you actually purchase the bond. On the other hand, an investor can profit from price declines in bonds by using an interest rate futures contract. With such a contract, two individuals agree that they will make payments to the counterparty based on interest rate movements over some specified time period. Another key difference is that with the futures contract (derivative) one person's loss is the counterparty's gain. The amount on the table never changes, it just moves between the counterparties. Yet another difference is that a futures contract is equivalent to a low-cost, leveraged exposure to fluctuations in the bond price.

You might also like to view...

During the recession phase of the business cycle, business firms become pessimistic about their future earning capacity as do banks. Nominal interest rates fall during recessions. Investment lending could be expected to

A) rise if the change in future earnings is thought to be greater than the change in interest payments. B) stay the same. C) fall. D) fall if the change in future earnings is thought to be greater than the change in interest payments.

Which of the following is correct?

a. The Federal Reserve is responsible for conducting monetary policy. b. The U.S. Treasury controls the money supply through its buying and selling of U.S. securities. c. The Treasury is a monetary agency with responsibilities very similar to those of the Fed. d. The Federal Reserve System issues U.S. securities.

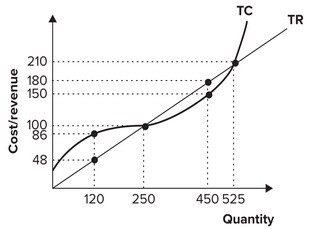

Refer to the graph shown. Other things equal, an increase in the market price of this product will cause:

A. an increase in total revenue and a decrease in the firm's profit-maximizing level of output. B. a decrease in total revenue and a decrease in the firm's profit-maximizing level of output. C. a decrease in total revenue and an increase in the firm's profit-maximizing level of output. D. an increase in total revenue and an increase in the firm's profit-maximizing level of output.

If output growth exceeds population growth for a country,

A. This country must have overcome the problem of opportunity costs. B. GDP must have fallen at a very rapid rate. C. Average living standards will increase. D. Per capita GDP will decrease.