Suppose that taxes on labor are increased by 10 percent and workers respond by working 2 percent fewer hours. It can be said that

A. The tax elasticity of the labor supply is 5.

B. The labor supply is elastic.

C. Employers will face lower unit costs for each worker hired.

D. The tax elasticity of the labor supply is 0.2.

Answer: D

You might also like to view...

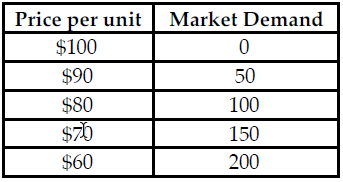

Refer to the table below. If this market is a Cournot Oligopoly and Firm X is produces 50 units, what is Firm Y's demand at a price of $60?

The table above shows the market demand for a product that both Firm X and Firm Y manufacture. Both firms produce an identical product and the firms' average total and marginal cost are equal and constant.

A) 150 B) 100 C) 200 D) 50

In the analysis of figure 11.2, discrimination leads to shifts in the demand curve for labor

Indicate whether the statement is true or false

Those who believe that market prices always incorporate all available information believe:

A. in the efficient-market hypothesis. B. that randomly choosing a stock is not as effective as technical or fundamental analysis. C. that current stock prices does not represent true value as correctly as is possible. D. All of these are true.

When a firm in a competitive market is earning profits, this indicates that the firm is

a. exploiting consumers. b. increasing the value of resources. c. blocking the entry of competing firms. d. reducing overall wealth in the market.