Suppose that you lend $5,000 to a friend who pays you back $5,400 the next year. Suppose that prices that year rose by six percent and the real rate of return in the stock market was five percent. Your friend says that he or she was being more than fair by giving you more than the rate of inflation as a return. What do you think?

What will be an ideal response?

The opportunity cost of that money was not just the six percent inflation, but also the real rate of return that would have been enjoyed had the money been put in the stock market. For you to have been indifferent between loaning your money versus keeping it, your friend should have reimbursed you by $5,550, or an 11% return. This is another example of considering all the costs, both the loss in purchasing power of the money due to inflation and the implicit cost of the return that could have been earned if the money was invested in the stock market.

You might also like to view...

Suppose eating soybeans leads to less cancer and heart disease. What effect would people eating more soybeans likely have on feed corn (a product also grown on land used to grow soybeans)?

A) The supply of feed corn will decrease. B) The cost of producing feed corn will increase. C) The price of feed corn will increase. D) All of the above.

Which of the following is not one of the four anti-competitive activities outlined in the Clayton Act?

a. Price discrimination. b. Exclusive buyer/seller contracts. c. Buying a competitor's voting stock. d. Buying a competitor's plants and equipment. e. Interlocking boards of directors.

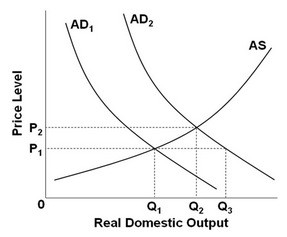

Refer to the above diagram. If AD1 shifts to AD2, then the equilibrium output and price level will be:

Refer to the above diagram. If AD1 shifts to AD2, then the equilibrium output and price level will be:

A. P1Q3. B. P1Q2. C. P2Q3. D. P2Q2.

A lender need not be penalized by inflation if the

A. long-term rate of inflation is less than the short-term rate of inflation. B. short-term rate of inflation is less than the long-term rate of inflation. C. lender correctly anticipates inflation and increases the nominal interest rate accordingly. D. inflation is unanticipated by both borrower and lender.