Cameo Industries desired a workplace free from all forms of sexual harassment. Accordingly, Cameo developed guidelines for its workers that specifically forbade sexual harassment. The guidelines gave examples of conduct that would not be tolerated,

provided penalties, designated a company official as the proper person to whom complaints should be brought, investigated complaints thoroughly, and maintained an educational policy designed to remind employees of the policy. Maureen, a Cameo Industries employee, made a complaint of sexual harassment, charging that her supervisor had demanded sexual favors. An investigation was performed and the charge was substantiated. The supervisor was warned not to continue this conduct, but it happened again. The supervisor was again issued a warning. Finally, Maureen brought a court action against the supervisor and Cameo. Cameo defended on the ground that it had done all in its power to rectify the situation. Decide.

?Although the intentions of Cameo may have been good, it appears that Cameo may be held liable. The company failed to appropriately discipline the supervisor, thus allowing the harassment to continue. Stronger disciplinary action was needed by Cameo, such as firing, transferring, or suspending the supervisor.

You might also like to view...

Frauds are more likely to occur in:

a. large, historically profitable companies. b. companies with an active board of directors. c. smaller companies where one or two individuals have almost all control in decision making. d. any company, as the probability of a fraud does not change with the size of a company.

Activity-based management focuses on enhancing activities that add value to the product and reducing those that do not

Indicate whether the statement is true or false

______ fit deals with the cultural and structural characteristics of the organization and how well the candidate will fit within that structure and culture.

A. Cultural B. Personality-job C. Ability-job D. Person-organization

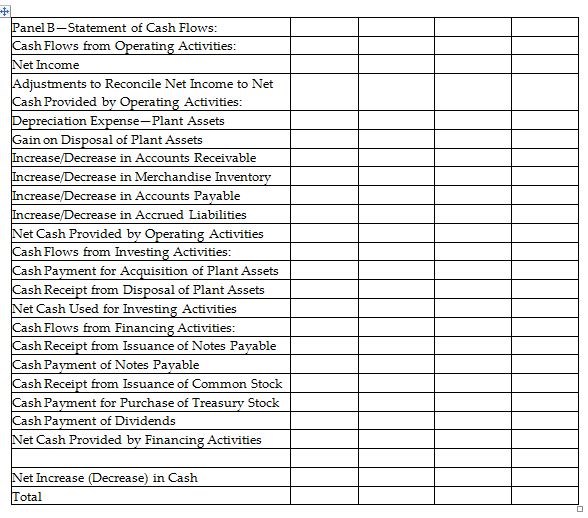

Redbird Company uses the indirect method to prepare its statement of cash flows. Using the following information, complete the worksheet for the year ended December 31, 2018.

- Net Income for the year ended December 31, 2018 was $49,000

- Depreciation expense for 2018 was $12,000

- During 2018, plant assets with a book value of $10,000 (cost $10,000 and accumulated depreciation $0) were sold for $14,000

- Plant assets were acquired for $52,000 cash

- Issued common stock for $28,000

- Issued long-term notes payable for $34,000

- Repaid long-term notes payable for $40,000

- Purchased treasury stock for 3,000

- Paid dividends of $10,000