A firm observes that in order to minimize the average cost, it must produce 25,000 units of output. Suppose the government imposes a specific tax on the output of the firm

Will the output level required to minimize the average cost increase, decrease, stay the same or is it uncertain? Can you tell how much the minimum average cost will change by? Explain.

The specific tax results in a parallel vertical shift of the average cost by the amount of the tax. Therefore, the minimum point will shift up by precisely the tax. The output level which minimizes the average cost will not change.

You might also like to view...

In 2008, the Treasury and Federal Reserve took several actions in response to the deepening financial crisis. One action was the Treasury's move to have the federal government take control of

A) JPMorgan Chase. B) Fannie Mae and Freddie Mac. C) the Federal Deposit Insurance Corporation (FDIC). D) Lehman Brothers.

If only one firm in an industry could take advantage of a reduced wage and all other firms continue paying the old wage, how would one best describe the one firm's reaction to this reduced wage assuming labor is the only variable input? The

marginal revenue product of labor curve A) would remain unchanged, and the firm would hire more labor at the lower wage. B) shifts to the left, and the firm hires more labor at the lower wage on the new curve. C) shifts to the right, and the firm hires more labor at the lower wage on the new curve. D) shifts to the left, and the firm hires less labor at the lower wage on the new curve. E) shifts to the right, and the firm hires less labor at the lower wage on the new curve.

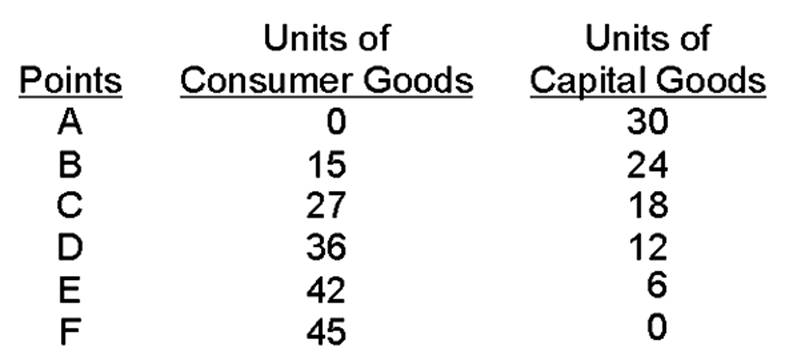

If the economy produces 27 consumer goods and 12 capital goods, the economy would be producing __________________ (outside/on/inside) the production possibilities curve.

Hypothetical Production Schedule for a Two-Product Economy

What kind of market runs most efficiently when one large firm supplies all of the output?

a) a natural monopoly b) a network c) perfect competition d) imperfect competition