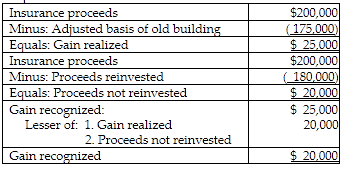

Stephanie's building, which was used in her business, was destroyed in a fire. Stephanie's adjusted basis in the building was $175,000, and its FMV was $210,000. Stephanie filed an insurance claim and was reimbursed $200,000. In that same year, Stephanie invested $180,000 of the insurance proceeds in another business building. If the proper election is made, Stephanie will recognize gain of

A) $0.

B) $15,000.

C) $20,000.

D) $25,000.

C) $20,000.

You might also like to view...

A description of the physical arrangement of records in the database is

a. the internal view b. the conceptual view c. the subschema d. the external view

Occupational Safety and Health Administration (OSHA) citations may be issued immediately following an inspection or later by mail.

Answer the following statement true (T) or false (F)

If Ben Stewart has a checking account at First Bank:

A) the relationship between Ben and his bank is based primarily on their contractual agreement. B) First Bank is a creditor and Ben is a debtor. C) Ben is an agent of First Bank. D) First Bank must honor all of Ben's checks.

This Act gave employees the right to organize and choose representatives to bargain on their behalf with employers

A) Norris-LaGuardia Act B) Wagner Act C) Taft-Hartley Act D) Landrum-Griffin Act