In the above figure, the average fixed cost curve is curve

A) A.

B) B.

C) C.

D) D.

D

You might also like to view...

If the Consumer Price Index was 125 in one year and 120 in the following year, then the rate of inflation is approximately

A. 4%. B. -4%. C. -4.2%. D. 4.2%.

If investment opportunities in the U.S. become more attractive to foreigners,

a. the exchange-rate value of the dollar will fall. b. the current-account balance will shift toward a deficit. c. the capital inflows to the U.S. will fall. d. all of the above are true.

If European economies experience strong economic growth, U.S. net exports will

a. increase and AD will shift rightward. b. increase and AD will shift leftward. c. decrease and AD will shift leftward. d. decrease and AD will shift rightward.

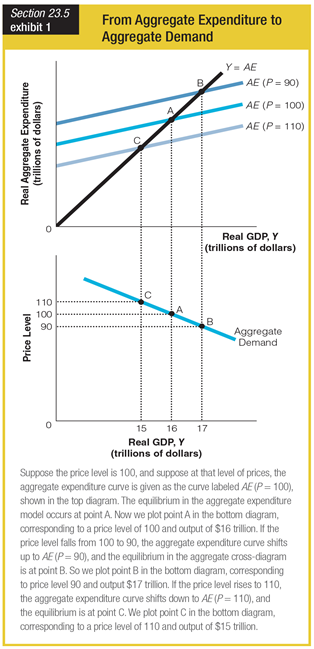

What do points A, B, and C have in common?

a. They all represent the effect of inflation.

b. They all represent the effect of changing interest rates.

c. They are all roughly equal.

d. They are all equilibrium points.