The "greenback": a.provided a uniform currency across the U.S. b.provided additional revenue for the government during the Civil War. c.supplied monetary increases that sent prices skyrocketing. d.All of the above are correct. e.Only a and b are correct

d. All of the above are correct.

You might also like to view...

A comparison of a traditional price support program and the Brannan plan shows that

a. consumers would clearly prefer the traditional program. b. farmers would clearly prefer the Brannan plan. c. losses due to inefficiency are completely avoided under the Brannan plan. d. the more elastic the supply and demand curves, the lower the relative cost of the Brannan plan will be. e. All of the above.

If sellers respond to very small changes in price by adjusting their quantity supplied by extremely large amounts, the price elasticity of supply approaches

a. zero, and the supply curve is horizontal. b. zero, and the supply curve is vertical. c. infinity, and the supply curve is horizontal. d. infinity, and the supply curve is vertical.

Suppose Larry's Lariats produces lassos in a factory, and uses nine feet of rope to make each lasso. The rope is put into a machine that automatically cuts it to the right length, then seals the ends to prevent fraying. The rope is then hand tied, dipped, and wound before being placed in a packaging machine to prepare it for retail sale. Which of the following would be considered a variable cost for this company?

A. Employee wages B. The cost of the factory C. The rope-cutting machine D. All of these expenses would be included in variable costs.

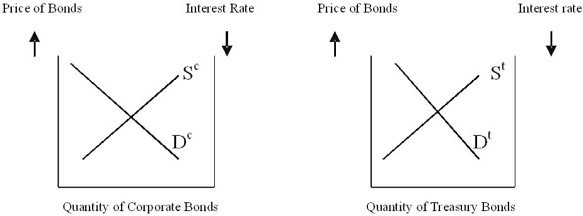

Please use the graphs to show what happens to the risk (yield) differential in each situation and why.  Assume the corporate and Treasury bonds have the same maturity;a) If the corporate bonds are default-risk free, what could you tell about the price and yields of each?b) If the corporate bonds are now viewed as having the possibility of default, what happens in each market?c) If the corporate bonds are granted tax-exempt status, what happens in each market?d) If the corporate bonds have a longer maturity than the Treasury bonds what would happen?

Assume the corporate and Treasury bonds have the same maturity;a) If the corporate bonds are default-risk free, what could you tell about the price and yields of each?b) If the corporate bonds are now viewed as having the possibility of default, what happens in each market?c) If the corporate bonds are granted tax-exempt status, what happens in each market?d) If the corporate bonds have a longer maturity than the Treasury bonds what would happen?

What will be an ideal response?