A tax that takes a larger proportion of income from low-income groups than from high-income groups is a:

A. stabilizing tax.

B. regressive tax.

C. proportional tax.

D. progressive tax.

Answer: B

You might also like to view...

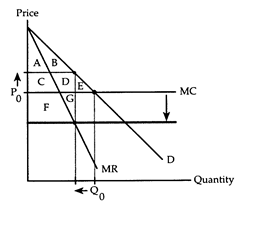

Refer to Horizontal Merger. If area F + G is larger than area E, we can conclude that the horizontal merger

The following questions refer to the accompanying diagram, which shows the effects of a horizontal merger. Before the merger, the firm behaves competitively producing Q0 and charging P0. The merger lowers the firm's marginal cost and gives the firm enough market power to switch to the monopoly equilibrium.

a. will reduce economic efficiency.

b. causes both consumers' and producer's surplus to rise.

c. will not increase the firm's profit and thus will not be undertaken.

d. creates an increase in social gain.

Suppose that workers in Transylvania can produce only two goods -- yo-yos or sweatsocks. The Transylvanian currency is the daler. In what unit is the opportunity cost of yo-yos measured?

a. dalers b. dalers per yo-yo c. dalers per sweatsock d. yo-yos e. sweatsocks

Which of the following changes would decrease the present value of a future payment?

a. a decrease in the size of the payment b. an increase in the time until the payment is made c. an increase in the interest rate d. All of the above are correct.

Which of the following is eroding the U.S. comparative advantage?

A. Intellectual property rights B. A depreciating dollar C. The spread of technology D. The law of one price