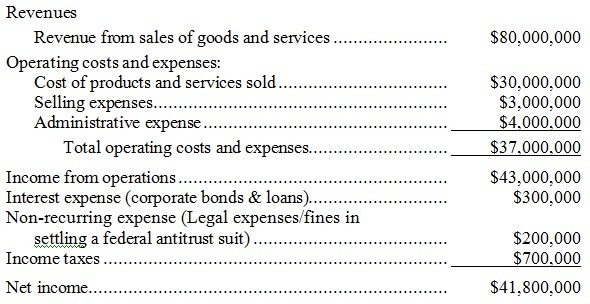

An annual income statement from Quest Realty, Inc. is shown below: During this year of operation, Quest Realty owned and occupied an office building in downtown Indianapolis. For this year, the building could have been leased to other businesses for $2,000,000 in lease income. Quest Realty also owned undeveloped land valued at $15,000,000. Owners of Quest Realty can earn a 14% rate of return annually on funds invested elsewhere.Total explicit costs of using market-supplied resources for Quest Realty for this year are

During this year of operation, Quest Realty owned and occupied an office building in downtown Indianapolis. For this year, the building could have been leased to other businesses for $2,000,000 in lease income. Quest Realty also owned undeveloped land valued at $15,000,000. Owners of Quest Realty can earn a 14% rate of return annually on funds invested elsewhere.Total explicit costs of using market-supplied resources for Quest Realty for this year are

A. $41,100,000

B. $37,000,000

C. $38,200,000

D. $23,000,000

E. none of the above

Answer: C

You might also like to view...

When interest rates are free from central bank manipulation, and fall due to an increase in household savings, this

A) provides an incentive for government to create a budget surplus. B) sends a "green light" signal for businesses to increase investment. C) has little impact on the macroeconomy. D) creates a "cluster of errors" and an inevitable recession.

The union participation rate in the United States is

a. lowest among service workers in the private sector b. highest among service workers in the private sector c. lowest among service workers in the public sector d. highest in heavy industry e. highest in high-technology industries

A reduction in the value of capital goods over time due to their use in production is called:

a. amortization. b. erosion. c. consumption. d. investment. e. depreciation.

In general, the accounting of trade in goods and capital is known as the:

A. trade surplus. B. balance of trade. C. net capital outflow. D. balance of payments.