Since 1970, the annual inflation rate in the U.S. has been about 9.7 percent or more.

Answer the following statement true (T) or false (F)

False

You might also like to view...

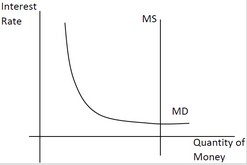

Use the following diagram to answer the next question. Based on this diagram, we can say ________.

Based on this diagram, we can say ________.

A. crowding out is limiting the effectiveness of expansionary monetary policy B. investment demand will not respond when interest rates change C. there is a liquidity trap D. monetary policy is likely to be pro-cyclical

If a bank receives a new transaction deposit of $10,000 and the reserve ratio is 15 percent, then the bank could expand its loans by as much as

A) $8,500. B) $1,500. C) $66,700. D) $15,000.

According to Say's law

A) supply creates its own demand. B) demand creates supply. C) changes in supply create supply-side inflation. D) changes in demand create demand-side inflation.

Public goods are overproduced in the marketplace

a. True b. False Indicate whether the statement is true or false