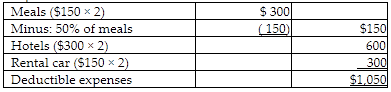

Norman, a self-employed lawyer, traveled to San Francisco for four days on vacation, and while there spent another two days conducting business. Norman's plane fare for the trip was $500; meals cost $150 per day; hotels cost $300 per day; and a rental car cost $150 per day that was used for all six days. Norman may deduct

A) $1,050.

B) $0.

C) $1,217.

D) $1,200.

A) $1,050.

Because the taxpayer spent more than half the days on vacation, the plane fare is not allowed at all.

You might also like to view...

________ are used to predict sales and profits from the prospective new product launch and to make certain that marketing, distribution, and production skills are developed before full-scale operations begin

A) Product use tests B) Market tests C) Sales forecasts D) Concept generation tests

Explain with an example how promissory estoppel affects the consideration requirement of contract law.

What will be an ideal response?

An accounting system that maintains an adequate audit trail is implementing which internal control procedure?

a. access controls b. segregation of functions c. independent verification d. accounting records

_________________ is the process of creating a shared identity among employees by adopting a common language, group boundaries, an accepted distribution of power and status, and norms of trust, rewards, and punishment.

a. External adaptation b. Internal integration c. Environmental diversification d. Macro diversification