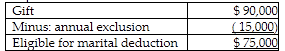

A husband transfers $90,000 by gift directly to his wife. The marital deduction for the transfer is

A) $0 unless he elects to claim one.

B) $90,000.

C) $75,000.

D) none of the above

C) $75,000.

You might also like to view...

______ describes corporate giving that supports a good environment in which to do business.

A. Philanthropy B. Stewardship C. Enlightened self-interest D. Institutional advancement

What is the name for the trial participant who "reports" every word of the open-court

proceedings and may prepare a transcript of the proceedings? a. Judge b. Bailiff c. Court clerk d. Court reporter

Provide a real-world example of a national brand and a private-label brand.

What will be an ideal response?

Retained earnings:

A. Can only be appropriated by setting aside a cash fund. B. Represent an amount of cash available to pay shareholders. C. Are never adjusted for anything other than net income or dividends. D. Represents the amount shareholders are guaranteed to receive upon company liquidation. E. Generally consists of a company's cumulative net income less any net losses and dividends declared since its inception.