Ruby and Anita are partners. Ruby has a capital balance of $270,000 and Anita has a capital balance of $180,000. Denis contributes a building with a current market value of $170,000 to acquire an interest in the new partnership. Which of the following is TRUE of the journal entry to record this transaction? (Assume no bonus to any partner.)

A) Building will be debited for $170,000, Ruby, Capital and Anita, Capital will be credited for $85,000 each.

B) Building will be debited for $170,000 and Denis, Capital will be credited for $170,000.

C) Ruby, Capital and Anita, Capital will be debited for $85,000 each and Denis, Capital will be credited for $170,000.

D) Ruby, Capital and Anita, Capital will be credited for $85,000 each and Denis, Capital will be debited for

$170,000.

B) Building will be debited for $170,000 and Denis, Capital will be credited for $170,000.

You might also like to view...

Bonds Payable should be classified as a long-term liability on a balance sheet unless the issue is

a. not maturing within one year of the balance sheet date. b. maturing within one year of the balance sheet date and is to be paid by segregated assets that are classified as long-term assets. c. maturing within one year of the balance sheet date and is to be retired by the use of current assets. d. maturing within one year of the balance sheet date and is to be replaced by another bond issue.

Being outside of the Four-Fifths Rule means we ___________ broke the law.

A. never B. definitely C. possibly D. eagerly

A statement of work may be included with what?

a. RFI b. RFP c. IFB d. Verbal quotes

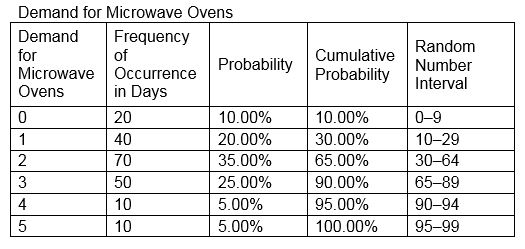

Consider the Demand for Microwave Ovens data set. What is the total demand corresponding to random numbers 29, 68, 35, 56, 46, and 72?

A. 13

B. 14

C. 15

D. 16