According to supply-side economics, changes in marginal tax rates will have which of the following effects?

A) change the incentive to work

B) change the incentive to save

C) change the incentive to invest

D) all of the above

Answer: D) all of the above

You might also like to view...

Other things constant, which of the following is likely to change the quantity of wheat supplied?

A) a government subsidy for farmers who do not grow wheat B) an increase in the price of soybeans C) a decrease in the price of the fertilizer used in wheat production D) a fall in the price of wheat E) an expectation of a future increase in wheat prices

In the aggregate expenditures model, equilibrium occurs if:

A. aggregate expenditures (AE) are greater than GDP. B. aggregate expenditures (AE) are less than GDP. C. there is no unplanned inventory depletion or accumulation. D. consumption equals investment.

The market tends to underproduce public goods because

A. The consumption of a public good by one person prevents the consumption of the same good by another person. B. It is difficult to measure the benefit of a public good such as national defense. C. The free-rider dilemma results in exclusive consumption of a good. D. Joint consumption allows those who do not pay for the good to still benefit from the good.

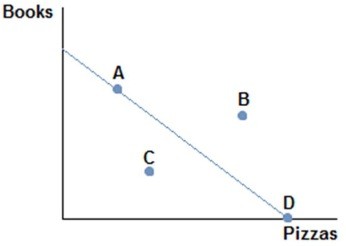

Consider the production possibilities frontier displayed in the figure shown. Which of the following statements is currently true?

Consider the production possibilities frontier displayed in the figure shown. Which of the following statements is currently true?

A. Producing at point C is the best choice, because it's closest to the middle. B. Producing at point B is impossible. C. Producing at point A is the best choice, because some of both items are made. D. Producing at point D would be inefficient, since no books would be produced.