In 2005, Lee began working as a nurse anesthetist with a taxable income of $119,000. The Medicare tax was 1.45% and the Social Security tax rate was 6.2% to the maximum income of $90,000 that year. How much did Lee pay in FICA taxes in 2005?

A. $9,103.50

B. $7,305.50

C. $5,580.00

D. $1,725.50

Answer: B

Mathematics

You might also like to view...

Round the whole number to the given place value.35, tens

A. 40 B. 50 C. 30 D. 43

Mathematics

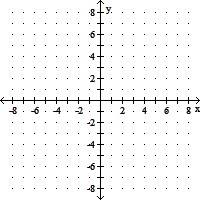

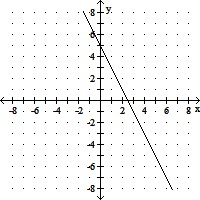

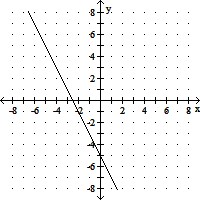

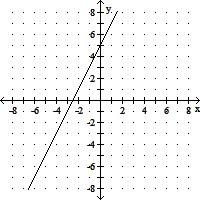

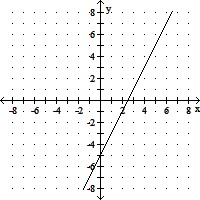

Graph using the slope and the y-intercept.y = -2x - 5

A.

B.

C.

D.

Mathematics

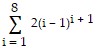

Rewrite the series using summation notation. Use 1 as the lower limit of summation.42 + 83 + 124 + . . . + 329

A.

B.

C.

D.

Mathematics

Find the distance between the given points.![]() A and F

A and F

A. -

B. -

C.

D.

Mathematics