A regressive income tax is defined as a tax for which

A) total taxes paid increase with the level of income.

B) total taxes paid are independent of the level of income.

C) the average tax rate increases with the level of income.

D) the average tax rate decreases with the level of income.

D

You might also like to view...

If Sam sells his product for $10 per unit net of costs and just breaks even after transporting it 5 miles to the market, Susan, who lives only 2 miles from the market will

a. experience lower profits b. earn a location rent c. find it profitable to purchase Sam's land d. derive a consumer's surplus e. none of the above

A bank would be considered insolvent when the value of its liabilities exceed its

a. assets. b. required reserves. c. actual reserves. d. net worth.

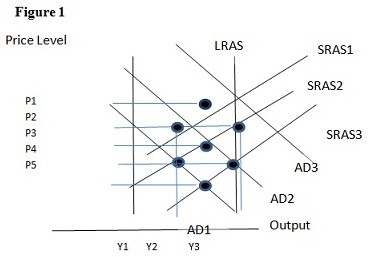

Using Figure 1 above, if the aggregate demand curve shifts from AD1 to AD2 the result in the short run would be:

A. P1 and Y2. B. P3 and Y1. C. P2 and Y2. D. P2 and Y3.

If a technological advance makes it possible to produce computers at a lower cost:

A. the demand for computers increases. B. the demand for computers decreases. C. the supply of computers increases. D. the supply of computers decreases.