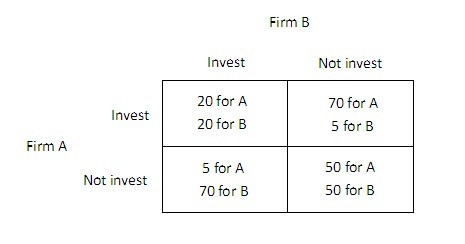

The payoff matrix below shows the payoffs (in millions of dollars) for two firms, A and B, for two different strategies, investing in new capital or not investing in new capital.  An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

An industry spy from firm A comes to firm B and offers to pay B in exchange for B's certain and enforceable promise to not invest. What is the most that firm A will be willing to pay B to not invest?

A. $30 million.

B. $50 million.

C. $20 million.

D. $35 million.

Answer: B

Economics

You might also like to view...

Which of the following is NOT a reason why people are motivated to hold money?

A) precautionary demand B) liability demand C) asset demand D) transactions demand

Economics

Why are foreign investors more likely to invest in U.S. government bonds than in U.S. corporate stocks and bonds?

What will be an ideal response?

Economics

The greater the elasticity of demand of a taxed item, the greater the tax revenue received

a. True b. False Indicate whether the statement is true or false

Economics

Consider the following game. You roll a six-sided die and each time you roll a 1, you get $50. For all other outcomes you pay $10. The expected value of the game is

A. -$10. B. $0. C. $10. D. $50.

Economics