Taxation and government spending are examples of fiscal policy tools used to stabilize an economy.

Answer the following statement true (T) or false (F)

True

You might also like to view...

The Malthusian model performs poorly in explaining economic growth after the

A) French Revolution. B) American Revolution. C) Industrial Revolution. D) Bio-technology Revolution.

Which of the following would be included in the government consumption and investment component of GDP?

a. the export of 100 fighter jets to Japan b. construction costs of a new public school building c. food stamps used by the Smith family d. a $1,000 check issued by the federal government as part of the Pell Grant program to help college students pay for school

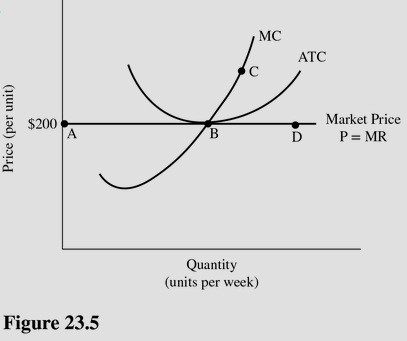

Refer to Figure 23.5 for a perfectly competitive firm. Which of the following is not true for this firm at a price of $200?

Refer to Figure 23.5 for a perfectly competitive firm. Which of the following is not true for this firm at a price of $200?

A. The firm is using the fewest resources possible to produce each unit of output. B. The price is a reflection of the highest-valued good that could have been produced with the resources the firm used for the last unit it produced. C. The firm is practicing marginal cost pricing. D. The firm should leave this market in an effort to earn economic profits.

Sustained inflation is

A. an increase in the overall price level that continues over a significant period of time. B. also called stagflation. C. the same as hyperinflation. D. a constant increase in the price of one product or service in the economy.