Solve the problem.Charles Williams owns Lake Shore Collectibles, a small shop with three employees. For one payroll period the total withholding tax for all employees was $1793. The total employee's Social Security tax was $673. The total employee's Medicare tax was $157. How much tax must Charles deposit as the employer's share of Social Security tax and Medicare tax? What is the total tax that must be deposited?

A. Employer's share of Social Security and Medicare tax = $830

Employer's tax deposit = $3277

B. Employer's share of Social Security and Medicare tax = $811

Employer's tax deposit = $1641

C. Employer's share of Social Security and Medicare tax = $830

Employer's tax deposit = $3453

D. Employer's share of Social Security and Medicare tax = $654

Employer's tax deposit = $3453

Answer: C

You might also like to view...

Solve the problem.If a person puts 1¢ in a piggy bank on the first day, 2¢ on the second day, 3¢ on the third day, and so forth, how much money will be in the bank after 30 days?

A. $4.65 B. $9.30 C. $0.30 D. $2.33

Solve the equation.27x = 81(3x - 5)

A.

B.

C. -

D.

For the quadratic function, tell whether the graph opens up or down and whether the graph is wider, narrower, or the same shape as the graph of  f(x) = 3x2 - 5

f(x) = 3x2 - 5

A. Up; wider B. Down; wider C. Down; narrower D. Up; narrower

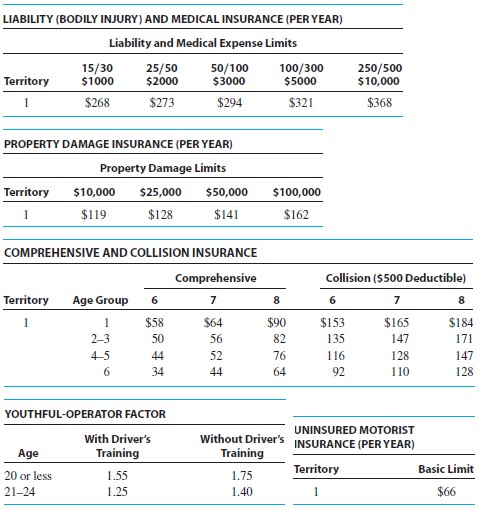

Find the annual premium in territory 1. Age: 61Comprehensive/Collision Age Group: 2Driver's Training: yesCategory: 7Liability: 100/300Property Damage: $50,000Uninsured Motorist: yes

Age: 61Comprehensive/Collision Age Group: 2Driver's Training: yesCategory: 7Liability: 100/300Property Damage: $50,000Uninsured Motorist: yes

A. $708.00 B. $665.00 C. $639.00 D. $731.00