Suppose the money supply grew at an average annual rate of 8%, velocity was constant, the nominal interest rate averaged 9%, and output grew at an average annual rate of 3%. According to the quantity theory,

a. inflation averaged 8% per year and the real interest rate was 9%.

b. inflation averaged 11% per year and the real interest rate was 17%.

c. inflation averaged 5% per year and the real interest rate was 4%.

d. inflation averaged 1% per year and the real interest rate was 6%.

c

You might also like to view...

Suppose we estimate that the demand elasticity for fine leather jackets is -.7 at their current prices. Then we know that:

a. a 1% increase in price reduces quantity sold by .7%. b. no one wants to buy leather jackets. c. demand for leather jackets is elastic. d. a cut in the prices will increase total revenue. e. leather jackets are luxury items.

If the U.S. interest? rate, adjusted for? people's expectation of? inflation, increases sharply relative to the rest of the? world, then

A) there will be a decrease in the demand for dollars in foreign exchange markets.

B) there will be no change in the demand for dollars in foreign exchange markets but there will be an increase in demand for foreign currency.

C) the dollar will appreciate.

D) the dollar will depreciate.

Suppose the government of South Island has fixed the value of its currency, the Islandia, at $0.50 per Islandia, but the market equilibrium value of the Islandia is $0.25 per Islandia. In order to maintain the official value of the Islandia the Central Bank of South Island must either ________ domestic interest rates or purchase Islandia, which causes the supply of international reserves to ________.

A. lower; decrease B. lower; increase C. raise; increase D. raise; decrease

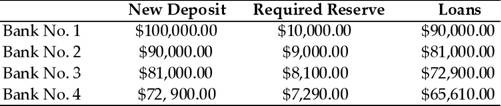

Refer to the information provided in Scenario 25.2 below to answer the question(s) that follow.SCENARIO 25.2: The following table shows the changes in deposits, reserves, and loans of 4 banks as a result of a $100,000 initial deposit in Bank No. 1. Assume all banks are loaned up. Refer to Scenario 25.2. What is the required reserve ratio?

Refer to Scenario 25.2. What is the required reserve ratio?

A. 4% B. 5% C. 8% D. 10%