Wary Corporation is considering the purchase of a machine that would cost $240,000 and would last for 5 years. At the end of 5 years, the machine would have a salvage value of $29,000. The machine would reduce labor and other costs by $63,000 per year. The company requires a minimum pretax return of 10% on all investment projects. (Ignore income taxes.)See separate Exhibit 13B-1 and Exhibit 13B-2, to determine the appropriate discount factor(s) using the tables provided.Required:Determine the net present value of the project.

What will be an ideal response?

| Year | |||||||||

| Now | 1-5 | 5 | |||||||

| Initial investment | $ | (240,000 | ) | ||||||

| Annual net cash flow | $ | 63,000 | |||||||

| Salvage value | $ | 29,000 | |||||||

| Total cash flows (a) | $ | (240,000 | ) | $ | 63,000 | $ | 29,000 | ||

| Discount factor (10%) (b) | 1.000 | 3.791 | 0.621 | ||||||

| Present value of cash flows (a) × (b) | $ | (240,000 | ) | $ | 238,833 | $ | 18,009 | ||

| Net present value | $ | 16,842 | |||||||

You might also like to view...

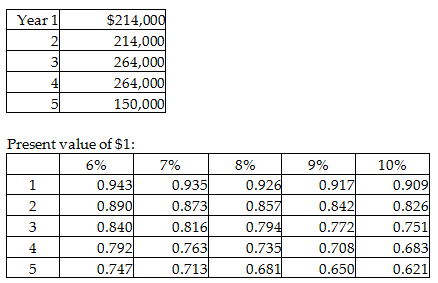

The company's annual required rate of return is 9%. Using the factors in the table, calculate the present value of the cash flows. (Round all calculations to the nearest whole dollar.)

Home Express Moving Company is considering purchasing new equipment that costs $728,000. Its management estimates that the equipment will generate cash inflows as follows:

A) $892,000

B) $864,646

C) $853,320

D) $894,000

Harrison Manufacturing has the following product information available: Sales price $50 per unit Variable costs $26 per unit Fixed costs $87,600 If Harrison is in the 35% tax bracket, how many units need to be sold in order to earn an after-tax target profit of $260,000?

A) 16,667 units B) 14,483 units C) 22,282 units D) 20,317 units

________ are a boom-or-bust business.

A. Installations B. Specialty items C. Accessories D. Professional services E. Supplies

Strict liability based on express warranties was applied originally to alcohol and tobacco products

a. True b. False Indicate whether the statement is true or false