An increase in the tax rate can cause total tax collections to fall if:

A. the tax is progressive.

B. higher taxes cause individuals to substitute leisure for labor.

C. the tax is regressive.

D. higher taxes cause individuals to substitute labor for leisure.

Answer: B

You might also like to view...

In the early 1990s Intel produced a 486 microchip for personal computers that contained a math co-processor that increased its speed of performing calculations and other operations

After a time Intel decided to disable the coprocessor on large numbers of their chips before sending them out for shipment and sale. What could have been the motive of Intel to deliberately reduce the quality of some of its chips?

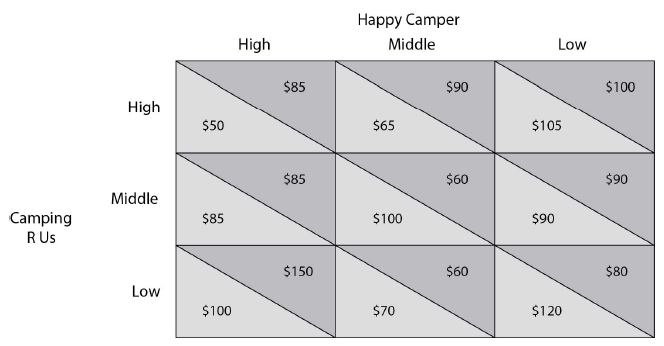

Refer to the payoff matrix below. Which of the following is true for Happy Campers?

A) The Low strategy dominates the Middle strategy

B) The High strategy dominates the Low strategy.

C) The Low strategy dominates the High strategy.

D) The Middle strategy dominates the Low strategy.

Which of the following could shift the labor supply curve and increase employment?

a. An increase in the number of firms b. An increase in income tax rates c. Increased spending on welfare programs d. Increased federal funding for education e. A decrease in income tax rates

In an eight-hour day, Andy can produce either 24 loaves of bread or 8 pounds of butter. In an eight-hour day, John can produce either 8 loaves of bread or 8 pounds of butter. The opportunity cost of producing 1 pound of butter is

A) 1/3 hour for Andy and 1 hour for John. B) 1 hour for Andy and 1 hour for John. C) 3 loaves of bread for Andy and 1 loaf of bread for John. D) 1/3 loaves of bread for Andy and 1 loaf of bread for John. E) none of the above