Churchill Company planned to raise $100,000 by issuing bonds. The bond certificates were printed bearing an interest rate of 8%, which was equal to the market rate of interest. However, before the bonds could be issued, economic conditions forced the market rate up to 9%. If the life of the bonds is 6 years and interest is paid annually on December 31, how much will Churchill receive from the

sale of the bonds?

a. Exactly $100,000 because Churchill Company would still pay interest at the face rate of 8%.

b. Less than $100,000 because the market rate of interest at 9% was more than the face rate.

c. Greater than $100,000 because the face rate of interest at 8% was less than the market rate.

d. The bonds would not be sold at all; Churchill Company would have the certificates reprinted bearing the market rate of 9%.

b

You might also like to view...

Pie charts, which are circles divided into sections, are useful for illustrating relative size or static comparisons

Indicate whether the statement is true or false

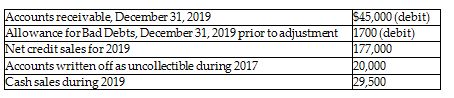

The following information is from the 2019 records of Albert Book Shop:

Bad debts expense is estimated by the aging-of-receivables method. Management estimates that $5200 of accounts receivable will be uncollectible. Calculate the amount of bad debts expense for 2019.

A) $4300

B) $6900

C) $3500

D) $5450

The primary difference between fixed and variable annuities is that

A) variable annuities have variable monthly payments during the accumulation period. B) the investment return on fixed annuities doesn't change. C) the value of the variable annuity can both increase and decrease. D) the annuity starting date can be changed for the variable annuity.

In person analysis, ________ relate(s) to resources employees need to help them learn.

A. feedback B. consequences C. inputs D. outputs