What is Lori's adjusted gross income?

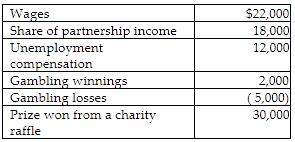

Lori had the following income and losses during the current year:

A) $72,000

B) $79,000

C) $82,000

D) $84,000

D) $84,000

Gambling losses, to the extent of gambling winnings, are deductible as itemized deductions and do not affect AGI. $22,000 + $18,000 + $12,000 + $2,000 + $30,000 = $84,000.

You might also like to view...

A study had 85 male and 85 female business students assigned to work together in mixed-sex teams of two. After the pairs of men and women negotiated with each other for the tasks they would work on,

a. the women ended up with more of the complex tasks b. the men ended up with more of the complex tasks c. on average the men and women ended up with equal numbers of complex tasks d. the students high on consideration leadership (regardless of gender) ended up with fewer of the desirable tasks

Benefits of virtual and global teams include

A) facilitate flexibility or agility in projects. B) increase speed and therefore shorten schedules. C) leverage expertise from dispersed knowledge workers. D) all of the above.

A team member is being egotistical when he or she claims credit for the work of others or dominates discussions or meetings. _________________________

Answer the following statement true (T) or false (F)

Gregory was a typist at a corporate firm. When the company adopted a special voice recognition software for the purpose of documentation, Gregory's job became redundant. Therefore, he was laid off. The increased use of technology in most companies has made Gregory's skills inessential, and he remained unemployed for a long time. In the given scenario, Gregory is facing _____.

A. seasonal unemployment B. structural unemployment C. frictional unemployment D. cyclical unemployment