Which of the following statements is false? An economic analysis of carbon taxes can:

A. predict the effect on unemployment in West Virginia coal mining communities.

B. conclude that such taxes should be imposed to benefit future generations.

C. present a trade-off of the costs and benefits of different levels of carbon taxes.

D. calculate the increase in costs faced by coal-using industries.

compare the likely reductions in medical expenditures on diseases caused by smog.

B. conclude that such taxes should be imposed to benefit future generations.

You might also like to view...

When there is a recessionary gap, inflation will ________, in response to which the Federal Reserve will ________ real interest rates, and output will ________.

A. decline; lower; decline B. increase; raise; decline C. decline; lower; expand D. decline; raise; decline

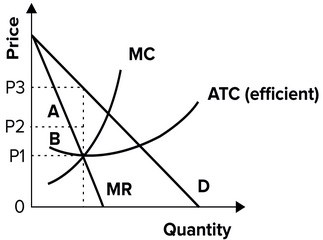

Refer to the following graph. A lazy monopolist is best described by earning area A and B in profits.

A lazy monopolist is best described by earning area A and B in profits.

Answer the following statement true (T) or false (F)

Pei Chen has a federal personal income marginal tax rate of 28 percent. His average tax rate

A. is more than 28%. B. is also 28%. C. is less than 28%. D. is zero.

Which of the following statements about inflation targeting is true?

A) Inflation targeting by the central banks in other countries has not typically lowered inflation. B) Inflation targeting would not reduce the flexibility of monetary policy to address other policy goals. C) Inflation targeting would not allow the central bank the flexibility to take action against a severe recession. D) Inflation targeting would make it easier for households and firms to form accurate expectations of future inflation, improving their planning and the efficiency of the economy.