By rescuing large, troubled institutions, as happened during the 2007-2009 financial crisis and recession with institutions like AIG and General Motors, policymakers attempted to achieve financial and economic stability in the short run, but their

actions may encourage even riskier behavior on the part of these large institutions in the future if these institutions believe that they, too, will be bailed out if they get in trouble. This risk faced by policymakers is known as A) asymmetric information.

B) quantitative easing.

C) too-big-to-fail policy.

D) moral hazard.

D

You might also like to view...

Lauren and Katy each bought a new bike lock for $20. Both Lauren and Katy would have paid $25 for the lock. The total consumer surplus for Lauren and Katy taken together equaled

A) $15. B) $10. C) $40. D) $20. E) $50.

Ramona has decided that she will only purchase a one-year Treasury bill with a face value of $15,000 if she receives an interest rate of 4.125%. How much will Ramona end up paying for this Treasury bill?

A) $12,447.66 B) $14,381.25 C) $14,405.76 D) $15,618.75

Which of the following is considered part of M2?

a. Savings deposits. b. Money market mutual fund shares. c. Small time deposits of less than $100,000. d. All of these.

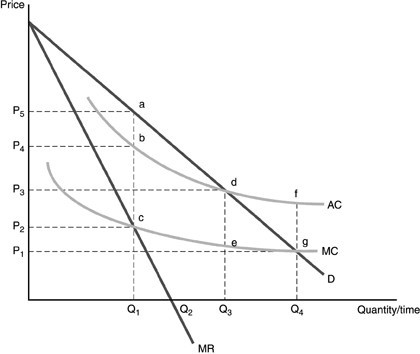

Refer to the above figure. An unregulated natural monopolist would choose

Refer to the above figure. An unregulated natural monopolist would choose

A. output rate Q1 and price P5. B. output rate Q3 and price P3. C. output rate Q4 and price P1. D. output rate of Q1 and price P2.