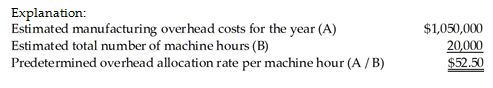

Arabica Manufacturing uses a predetermined overhead allocation rate based on the number of machine hours. At the beginning of the year, it estimated total manufacturing overhead costs to be $1,050,000, total number of direct labor hours to be 4000, and total number of machine hours to be 20,000 hours. What was the predetermined overhead allocation rate? (Round your answer to the nearest cent.)

A) $262.50 per machine hour

B) $43.75 per direct labor hour

C) $52.50 per machine hour

D) $65.63 per direct labor hour

C) $52.50 per machine hour

You might also like to view...

Displays that contain piles of sale clothing and marked-down goods are called _____

a. assortment displays b. cut cases c. dump bins d. rack displays

____ are gestures that are much like sign language (the hitchhiker’s thumb, the OK sign with thumb and forefinger, the “V” sign for victory).

a. Facades b. Exposure c. Emblems d. Feedback

If a business is unhappy with an agency sanction resulting from informal procedures it:

a. cannot do anything about it b. can appeal to the Supreme Court c. can seek review, beginning with the agency head d. can request monetary compensation e. none of the other choices are correct

The next generation web-based architectures will help to deliver ________ access to ERP systems

A) limited B) centralized C) short term D) ubiquitous E) none of the above