Suppose a firm anticipates that a particular R&D expenditure of $100 million will result in a new product and thus create a one-time added profit of $108 million a year later. The firm will:

A. undertake the R&D expenditure if its interest-rate cost of borrowing is 12 percent.

B. undertake the R&D expenditure if its interest-rate cost of borrowing is 10 percent.

C. not undertake the R&D expenditure if its interest-rate cost of borrowing is 9 percent.

D. not undertake the R&D expenditure if its interest-rate cost of borrowing is 7 percent.

Answer: C

You might also like to view...

Refer to Figure 2-4. A movement from Y to Z

A) represents an increase in the demand for plastic products. B) is the result of a decrease in preference for food products. C) is the result of advancements in plastic production technology. D) is the result of advancements in food production technology.

What are the benefits of bankruptcy laws that enable lenders to seize the assets of firms that default on loan contracts?

What will be an ideal response?

When a firm is experiencing economies of scale, it will:

a. underuse a larger plant size than is indicated by short-run efficiency concerns. b. underuse a smaller plant than is indicated by short-run efficiency concerns. c. overuse a larger plant size than is indicated by short-run efficiency concerns. d. overuse a smaller plant size than is indicated by short-run efficiency concerns. e. produce at the minimum short-run and long-run average costs.

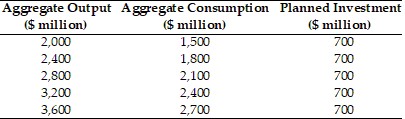

Refer to the information provided in Table 23.10 below to answer the question(s) that follow. Table 23.10 Refer to Table 23.10. Planned investment equals actual investment at

Refer to Table 23.10. Planned investment equals actual investment at

A. all income levels. B. an income level of $2,800 million. C. all income levels below $2,800 million. D. all income levels above $2,800 million.