A decrease in expected inflation for any given nominal interest rate will cause:

A. bond prices to decrease and interest rates to increase.

B. the bond supply curve to shift to the left.

C. the bond demand curve to shift to the left.

D. bond prices to increase and interest rates to decrease.

Answer: D

You might also like to view...

which of the following is a private owner prohibited from doing?

What will be an ideal response?

The stock market is also known as the ________.

A) capital market B) foreign-exchange market C) bond market D) equity capital market

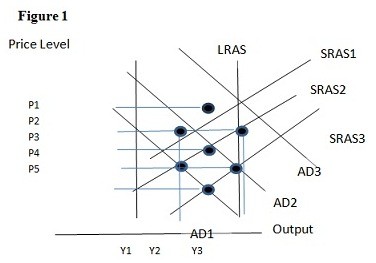

Using Figure 1 above, if the aggregate demand curve shifts from AD2 to AD1 the result in the long run would be:

A. P4 and Y1. B. P4 and Y2. C. P5 and Y1. D. P5 and Y2.

Compared with a system of fixed exchange rates, currency unions are beneficial because they

A. allow every country to have an independent monetary policy. B. restrict what countries can do with fiscal policy. C. allow exchange rates to float. D. eliminate the possibility of speculative attacks.